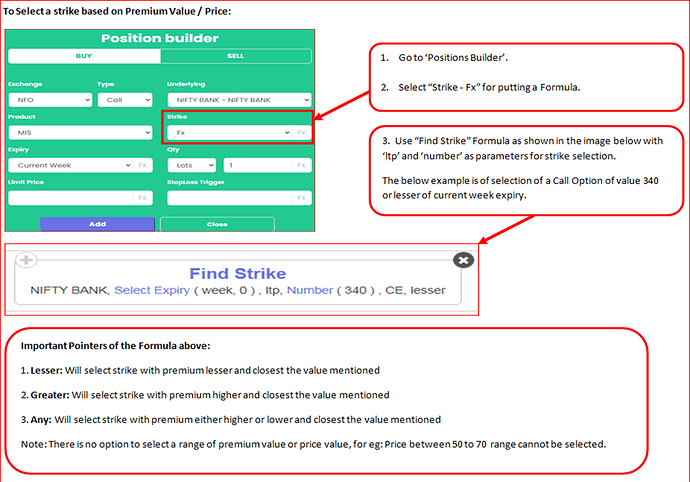

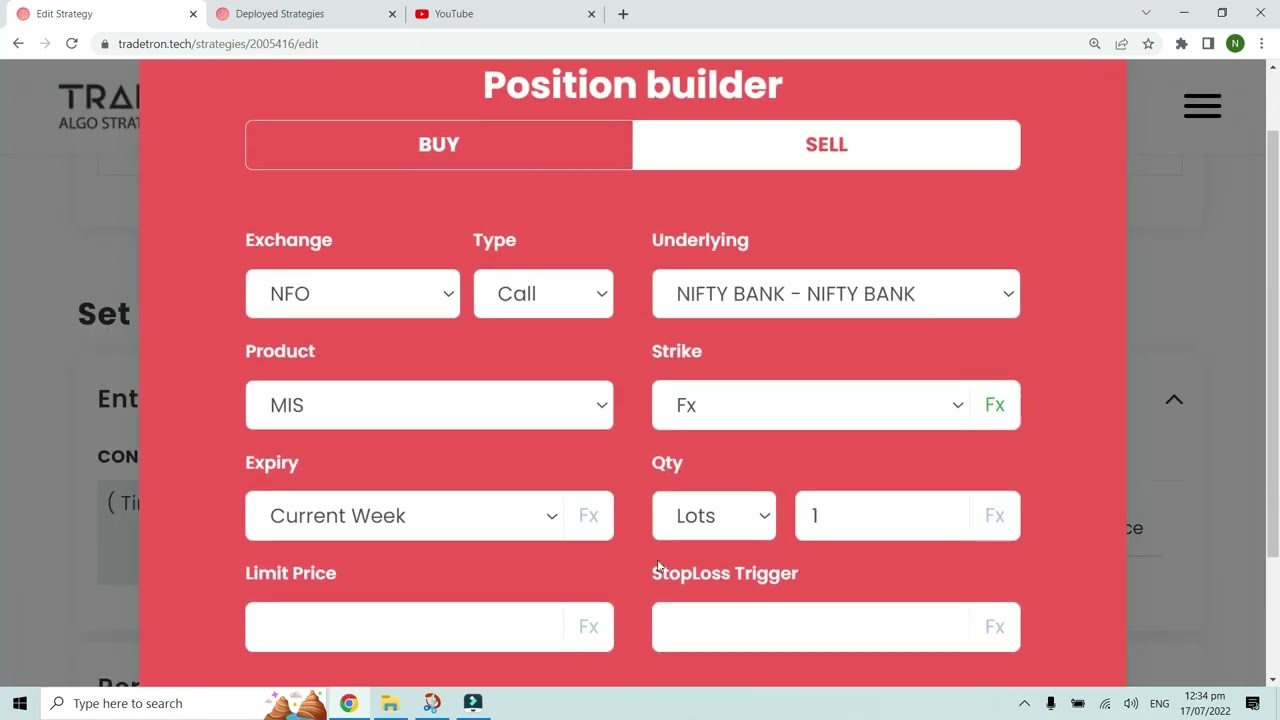

In this thread we will discuss how we can use different formulas under “Strike Fx” section of the Position Buillder:

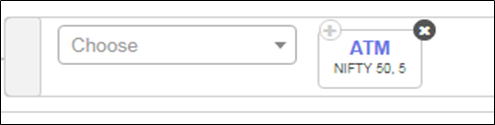

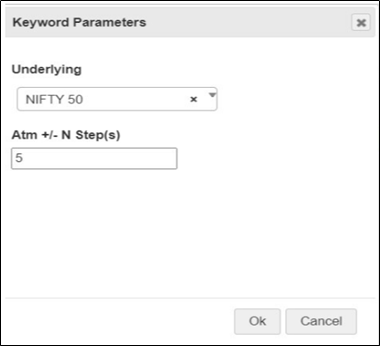

To Select 5 Strikes OTM for NIFTY 50 Futures Index, we will use following formula in “Strike Fx” section of the Position Builder:

Note that By Default, ATM keyword will select ATM based on ‘Futures Index’.

In Fx Builder to go 5 Strikes OTM

How to Select Strike based on Spot Index? Also OTM and ITM strikes based on Spot Index?

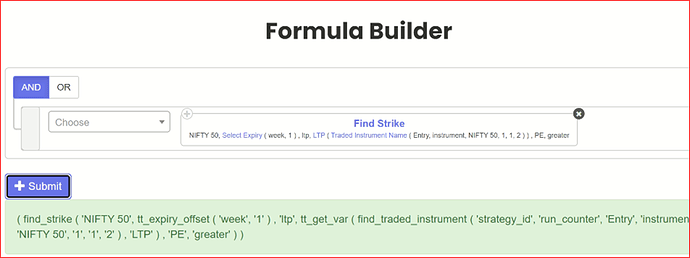

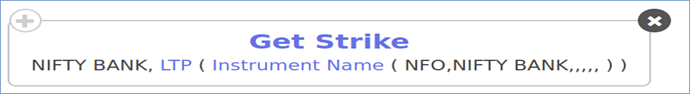

To Find Put Option Strike Closer in value to the current price of the Traded Instrument in Set,1,1,1

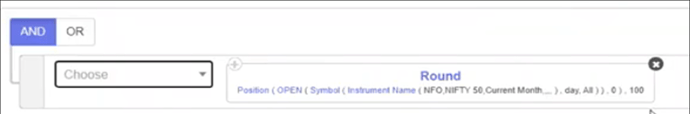

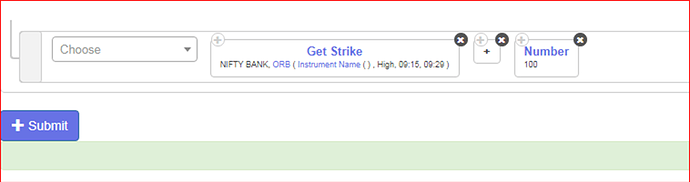

So the following will give you the Strike, which is multiple of 100, nearest to Open Price of Nifty Future for the day.

Question:

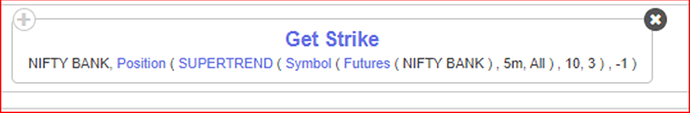

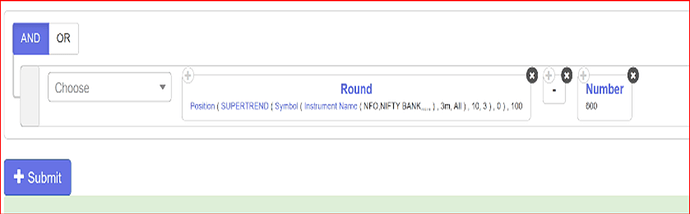

To select Strike based on Supertrend value

Solution:

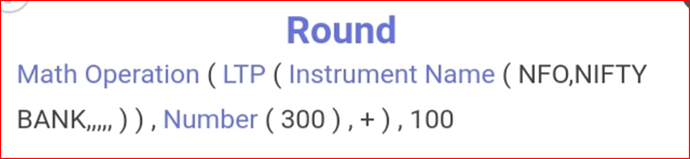

To select strike 600 points away from Supertrend Strike:

Question:

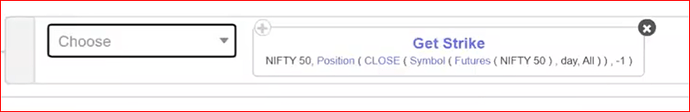

“Get Strike” Keyword:

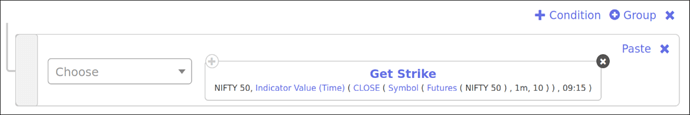

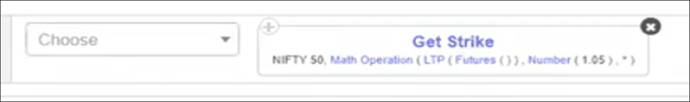

To take a position that is 5% away from current futures price.

Get Strike of Nifty using Math Operation as per LTP and a Number of 1.05, for 5%

Solution:

Question:

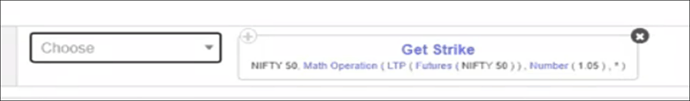

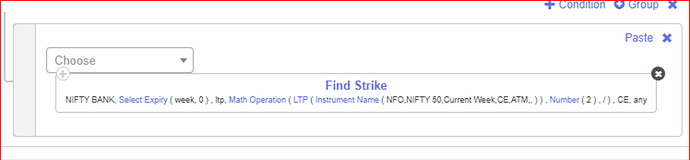

“Get Strike” Keyword, “Math Operation” 5% above from current levels, LTP of futures of Nifty

Solution:

Question:

“I need to find a strike with premium equals half of the ATM premium value”

ex: Suppose ATM PE premium at 120 then i need to find a strike in CE with premium 60.

Solution:

Will this select atm based on spot or based on futures?

I want to find strike price for ce and pe using below formula

strike for ce = low of first 5 min +(range of first 5 min candle x 2)

strike for pe = high of first 5 min -(range of first 5 min candle x 2)

Please provide screenshot of the formula in tradetron

Sumitd13 - Not possible to achieve this with current features.

It is possible as and when Tradetron provides an option to set runtime variable without taking position