Okay, this is an interesting scenario and maybe more a question for Tradetron.

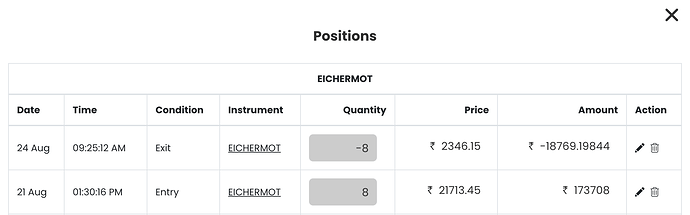

So my strategy bought 8 shares of Eicher on 21st August @ 21713 and sold them at open for a price of 2346 because mathematically that is a huge loss. However, considering the stock split either the quantity should have gone up to 80 or my purchase price should have gone down to 2171.3 and the strategy should not have sold the stocks here.

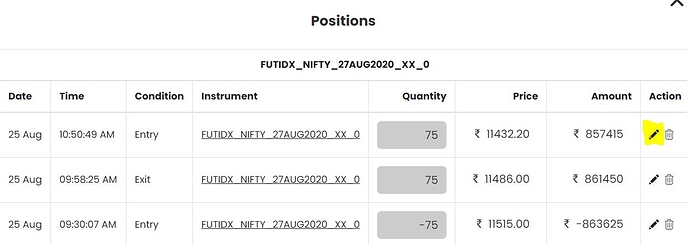

@vikram.bajaj any views into stock split adjustment will be useful. You may need Truedata to provide adjusted historical data but quantities will need to be adjusted at Tradetron.

An additional challenge that I foresee: Unless the historical data is adjusted, all my calculations and indicators will give incorrect calculation for the timeframe in which I am working, e.g. a 14 period RSI on daily will start showing correct values only after 14 days.