In this thread we will discuss all examples of using Delta related keywords:

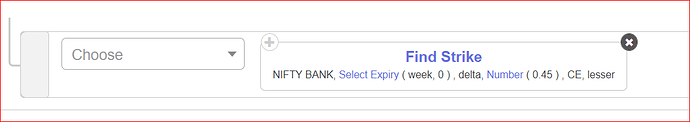

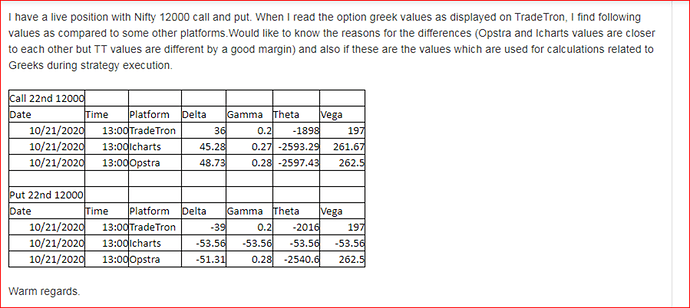

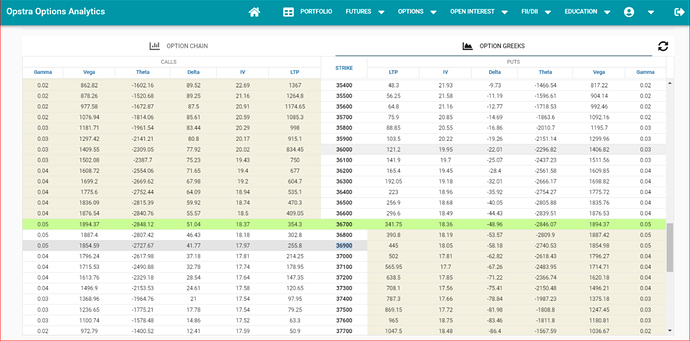

- Delta

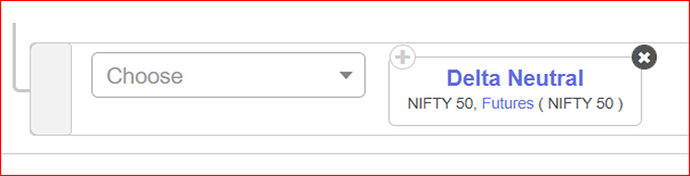

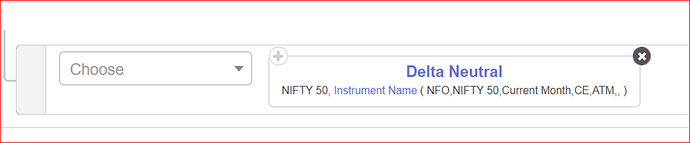

- Delta Neutral

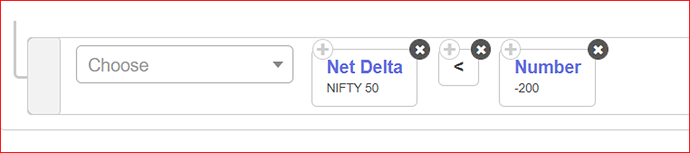

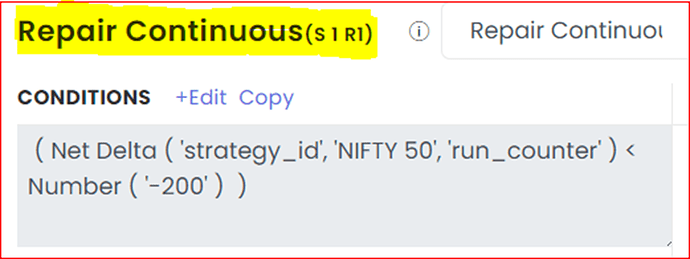

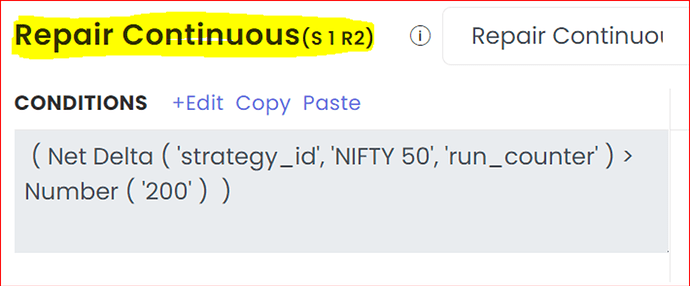

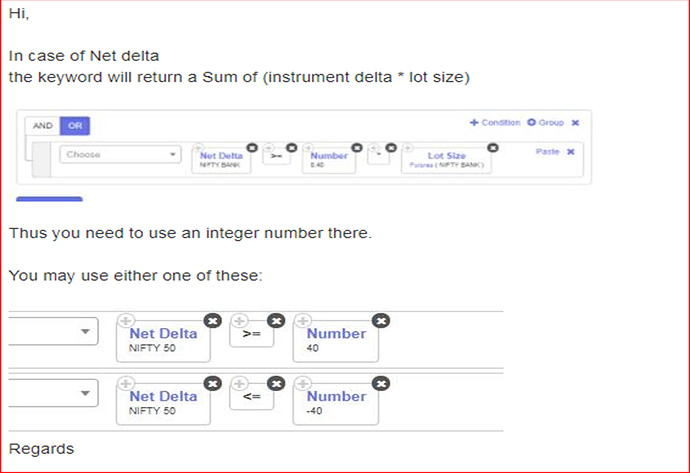

- Net Delta.

Key Points:

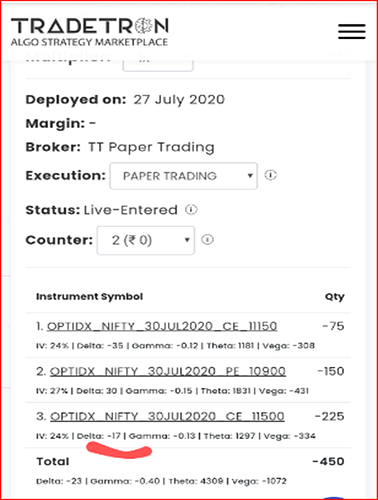

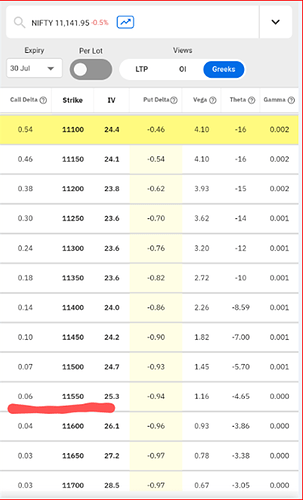

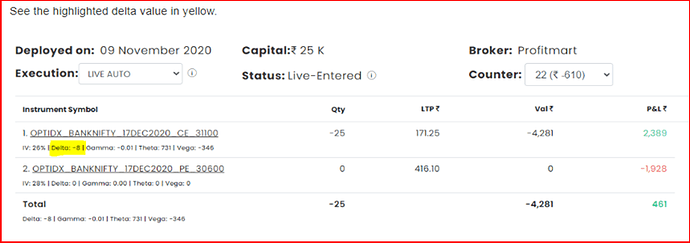

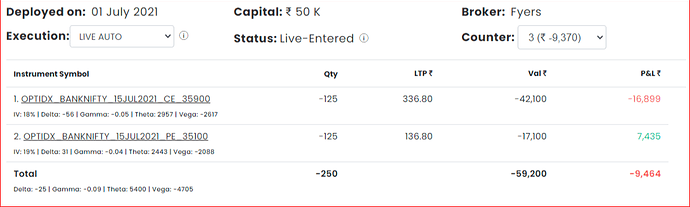

- Net Delta Checks collective Delta of open positions of the selected underlying in the strategy.

- Note that Delta is between 0 to 1 for Calls (Calls have positive Delta)

- Note that Delta is between 0 to -1 for Puts. (Puts have negative Delta)

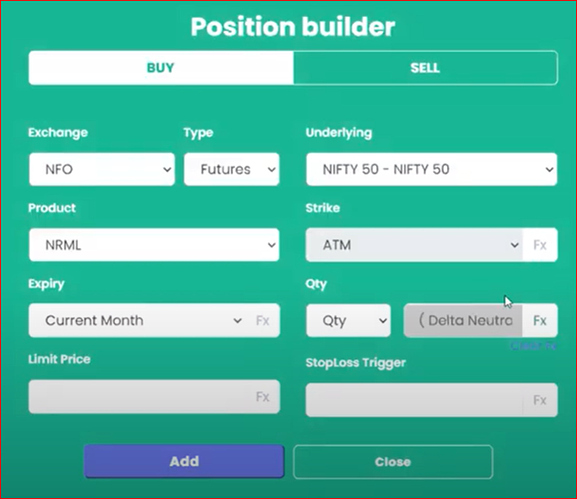

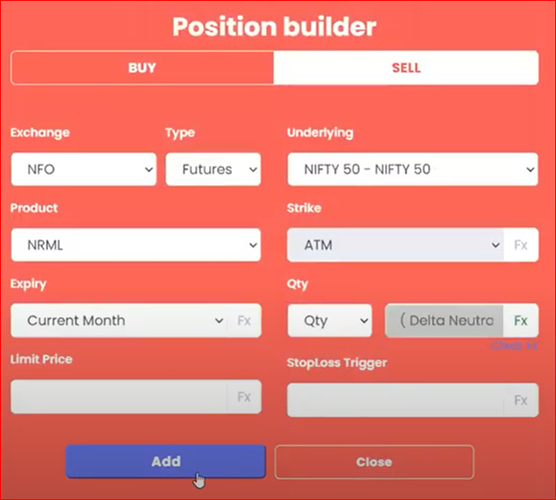

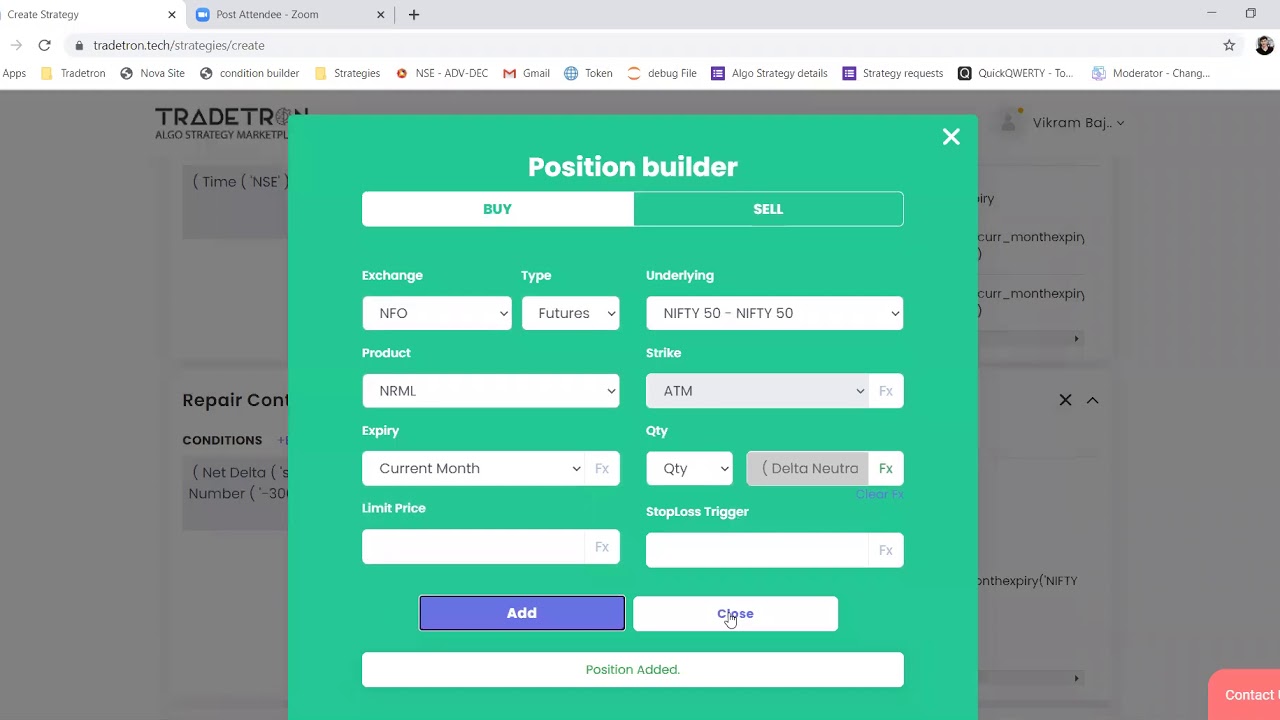

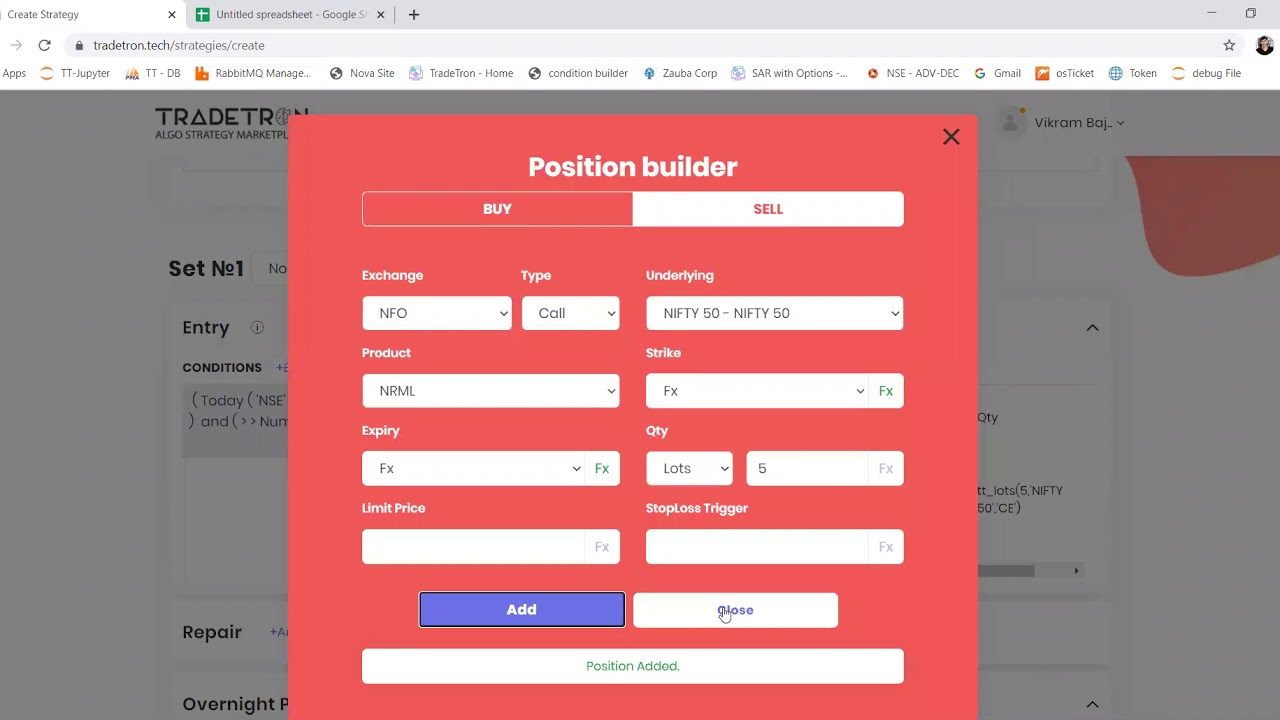

- ‘Delta Neutral’ Keyword can only be used in Qty Fx.

- Delta Neutral:

For Underlying: Quantity of selected instrument required to make net delta of all positions in strategy of selected underlying to zero.Returns quantity in multiple of lot size of Instrument as float

For Instrument Name: Eg. Delta Neutral(‘NIFTY 50’,‘OPTIDX_NIFTY_26DEC2019_CE_12000’) : Returns quantity of ‘OPTIDX_NIFTY_26DEC2019_CE_12000’ required to make positions of NIFTY Delta Neutral