This thread will discuss all the features and options available in advanced settings and its features.

Trailing Stoploss Explanation:

Blog: Trailing stop loss on Tradetron:

https://blog.tradetron.tech/node/35

Also, we have uploaded a couple of videos related to use of Trailing Stoploss:

Trailing Stoploss Settings:

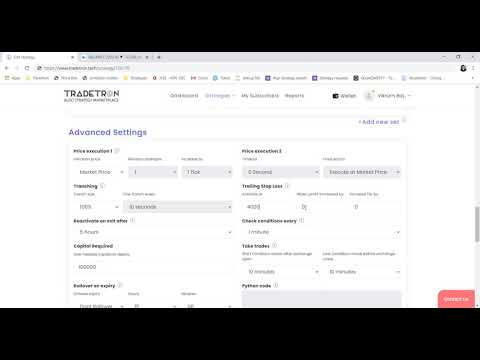

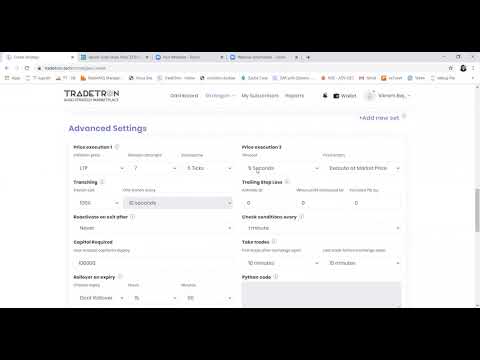

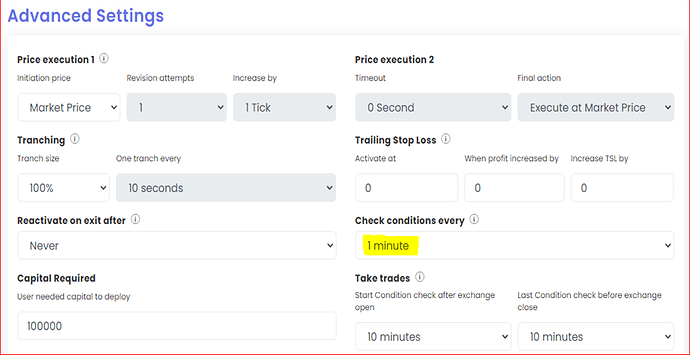

There are 3 settings you can use to setup the Trailing Stop loss feature on your strategy.

Activate at allows you to set the absolute amount of money the strategy should be in profit for the TSL to get activated. At this level the TSL will set to 0 which means if the profit falls back to 0, the strategy will exit and you will not end up making no profit no loss.

As the profit increases and goes in favour of your strategy, you want to trail the stop loss so that you dont give away all the notional profit the strategy had made. For which you use the other 2 settings … You can set it up to increase the TSL by xxx amount when the profit increases by yyy … So lets say you activate the TSL at 3000 profit and then choose to increase it by 1000 with every 1000 increase in profit. So when the profit touches 4000, the TSL will be at 1000 and at 5000 profit it will be at 2000 ; now if the profit drops to 2000, the strategy will exit for all positions.

A write-up on Trailing Stoploss:

- Trailing stoploss automatically adjusts as per the ‘multiplier’ selected for the strategy. For eg: if Activate is at 500 on a 1x multiplier, it will automatically adjust to 1000 on a 2x multiplier. No additional settings are needed to change the same.

- Trailing stoploss is calculated for the entire strategy level as a current feature. If you need Trailing Stoploss for Individual sets, it will need to be custom coded in Python by our quant team. Hence, please write to [email protected] for the same. And yes, it will have additional coding charge which will be communicated to you before we get started.

Following 2 Videos discuss how Trailing Stoploss is used in Tradetron:

Please read the below blog on Trailing Stoploss.

https://blog.tradetron.tech/node/35

Conditions Check Frequency:

"Conditions checking frequency / Conditions Check Frequency is basically the time interval at which the conditions of the strategy are checked.

- In 1 Minute Condition Check = Strategy Conditions are checked every 1 minute, not continuous, eg: At 9.20, then at 9.21 and so on, so there can be delay in execution of trades by 1 minute.

- In Continuous Check = Strategy Conditions are checked every second, so there is hardly any delay in execution.

Continuous check is beneficial in reducing slippages in trading and executing orders on time. - For marketplace strategies, it does not matter as all orders are executed on time as per the strategy on a continuous check basis irrespective of the plan. Marketplace strategies get traded on real time basis for all clients.

- One more drawback of 1 minute condition check is that, there is a possibility that the condition criteria may have met either before 1 min, but it may not be considered unless it is true with condition check happens at the end of that minute. Hence, possibility of false signals / entries."

Question: Is it possible to have percentage wise Tick increase in price execution in advanced settings?

Answer: No. Its not possible to revise based on %. Currently our system accepts only ticks in this parameter.